We are glad to announce the next edition of our "Flagship Program" NISMV - A Mutual Fund Distribution Certification Exam.

There are some facts, why you should start with Mutual Fund Business.

1. Post Demonetisation Economy :

After the demonetisation, we have seen a huge changes in whole financial industry. Apporx Rs.11.63 Lac Crore amount deposited in India Banking Industry. How it will benefit to you, broadly in India people prefer following tools for investment :

Fixed Deposit

Till date major part of India saving goes to banking or post office in form of fixed or recurring saving. After demonetisation, most of bank started to decreasing FD rates (SBI offering 7% for 365 days).

Real Estate

Till demonetisation, real estate market was in boom. We all know the current situation of either commercial or housing property.

Direct Equity Market

Person should have good knowledge on stocks selection. There is very high risk of bearish market. Investor may loss their investment.

Mutual Fund

In mutual fund, investor’s investment are managed by the professional fund manager. All schemes and investment are closely watch by Assets Management Companies, Association of Mutual Fund in India (AMFI) & SEBI. This means investors saving are safe / trust to invest in Mutual Fund. Due to various investment option available, mutual fund is very lubricative investment option.(Interesting data related to India Mutual Fund below)

2. Increase in product awareness :

According to current survey by economics times show that mutual fund investment is the most like product in Indian investor. Mutual fund folios in India rose 4.47% quarter-on-quarter in the three months ended December to a new record, indicating growing retail investors’ interest.

Mutual funds added 1.64 million folios from the quarter ended September to reach 50.6 million in the December quarter, according to Association of Mutual Funds of India (AMFI).Compared to the same quarter a year earlier, folios rose 6.97 million, or 15.2%, data showed.

3. Wide range of investment option :

Mutual Fund has wide range of products like, debt fund for conservative people, equity for long term investment, ELSS for tax saving purpose,etc.

4. Secured from Investor Point of View :

Since Mutual fund investments are manage by professional fund managers, so they care about investment & according to their centiments.

5. Fast growing industry in economy :

During the year ended December 2016, asset management companies, or AMCs, grew their average assets by around 30% by adding investments worth at least Rs3.71 trillion to their MF portfolios. the highest ever in absolute terms and the highest since December 2009 in percentage terms.

Some facts & figures about Mutual Fund in India :

-

Mutual Fund SIPs accounts stood at 1.31 CRORE! And the total amount collected through SIP during February 2017 was ?4,050 crore.

-

AMFI data shows that the MF industry has been adding about 6.18 lacs SIP accounts each month on an average during the current financial year, with an average SIP size of about ?3,100 per SIP account.

-

Average Assets Under Management (AAUM) of Indian Mutual Fund Industry for the month of February 2017 has crossed a landmark of ? 18 lakh crore and stood at ? 18.48 lakh crore. Assets Under Management (AUM) as on February 28, 2017 stood at ?17.89 lakh crore.

-

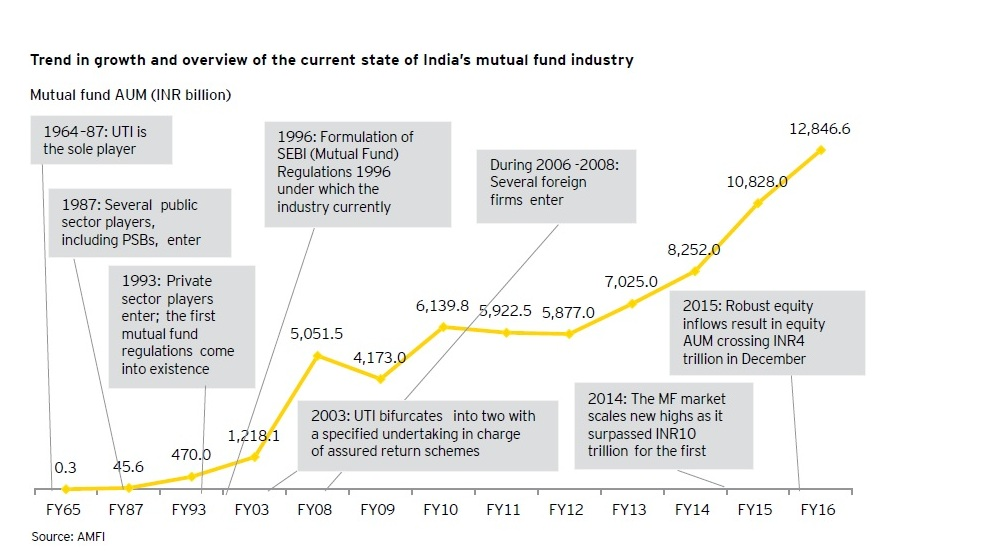

The AUM of the Indian MF Industry has grown from ? 3.26 trillion as on 31st March 2007 to ? 17.89 trillion as on 28th February, 2017, a five-fold increase in a span of less than 10 years !!.

-

The MF Industry’s AUM has more doubled in the last 4 years from ? 5.87 trillion as on 31st March, 2012 to ? 12.33 trillion as on 31st March, 2016.

-

The Industry’s AUM had crossed the milestone of ?10 Trillion (?10 Lakh Crore) for the first time in May 2014 and in a short span of two years and nine months, the AUM size has crossed ?17.89 lakh crore last month.

-

The total number of accounts (or folios as per mutual fund parlance) as on February 28, 2017 stood at 5.44 crore (54.4 million), while the number of folios under Equity, ELSS and Balanced schemes, wherein the maximum investment is from retail segment stood at 4.35 crore (43.5 million).

What is a module of exam ?

-

Revision of NISM-Series-V-A: Mutual Fund Distributors (MFD) Certification Examination w.e.f April 14, 2017.

-

The examination seeks to create a common minimum knowledge benchmark for all persons involved in selling and distributing mutual funds including.

-

Individual Mutual Fund Distributors.

-

Employees of organizations engaged in sales and distribution of Mutual Funds.

-

Employees of Asset Management Companies specially persons engaged in sales and distribution of Mutual Funds.

-

The certification aims to enhance the quality of sales, distribution and related support services in the mutual fund industry.

Examination Objectives:

On successful completion of the examination the candidate should :

-

Know the basics of mutual funds, their role and structure, different kinds of mutual fund schemes and their features.

-

Understand how mutual funds are distributed in the market-place, how schemes are to be evaluated, and how suitable products and services can be recommended to investors and prospective investors in the market.

-

Get oriented to the legalities, accounting, valuation and taxation aspects underlying mutual funds and their distribution.

-

Get acquainted with financial planning as an approach to investing in mutual funds, as an aid for mutual fund distributors to develop long term relationships with their clients.

About exam / Assessment Structure :

-

This is a Mock Examination of NISM-Series-V-A:Mutual Fund Distributors Certification Examination.

-

Please note that the actual examination for NISM-Series-V-A: Mutual Fund Distributors has 100 questions of 1 mark each.

-

There is no negative marking.

-

The passing score on the examination is 50%.

-

This mock examination is only to give the candidates an experience of NISM testing system.

-

Certificate valid for 3 Years.

Who can appear for this exam?

-

The person who willing to start with Mutual Fund Advisory Business.

-

Insurance agent, Stock Broker, any financial consultant who are seeking to enhance their business.

-

The candidate who want to renew their mutual fund (AMFI) certificate.

-

The employee who wants to renew their mf certificate.

-

Students who are willing to know about mutual fund.

Why Deep Knowledge & Investment :

We believe that Knowledge is what can separate you from the pack. It can take you as high as you want to go if you put it into action. An investment in knowledge pays the best interest.

We provide the platform where you can clear the exam successfully with help of expert design training, mock papers, study materials.

Available Exam Modules:

-

• Complete Pack : Pack includes everything required to clear the exam (Best for newcomer).

1. NISM V-A Exam Fees

2. Online Training (3 Hours of video lecture, which includes 12 lecture topic)

3. Study Material (Additional charges for physical study material)

4. Mock Paper (4 Practice Test Paper with Solution)

Fees : Rs.3000/- Click Here to Register

-

-

• Exam Only : Those candidates willing to appear for an exam without any training & mock papers or ARN Holder who are willing to renew their certificate can opt for this module.

1. NISM V-A Exam Fees

2. Study Material (Additional charges for physical study material)

Fees: Rs.1800/- Click Here to Register

For more detail, you can write to us at info@dkinvestment.org or Call us at +91 9157299337/38.